Leasing Information

Leasing thru Signs Manufacturing™

- "LEASE-TO-OWN" - You own your signs.

- FLEXIBLE - You pick your payment due date. You pick the term of your loan.

- EASY - There are no detailed financial papers needed and within just a few hours, your line of credit will be available for you.

- PROTECTS YOUR LINE OF CREDIT - No interference with your key borrowing lines of credit.

- PERSONAL CREDIT PROTECTION - No reporting to the personal credit agencies. Your account is recorded as a business expense, not a personal debt.

- NO ADDED COLLATERAL NEEDED - No blanket liens filed, no compensating bank balances required.

- AVOID ALL UP-FRONT COSTS - Installation, training, delivery etc. can all be included in the Lease.

- SIGNAGE, AND OTHER EQUIPMENT, CAN BE COMBINED IN YOUR LEASE - Furniture, cash registers, cooking equipment, shelving, etc.

- GENERATE REVENUE - Allows your sign to pay for itself with usage. It is proven that a sign generates more than 50% of a businesses revenue all by itself; and a better, generally more expensive, sign generates more business. Be able to spend more for a better sign.

- PROTECTION AGAINST RISING COSTS - Start with a sign that will make you successful, using today’s pricing. Don't be disappointed by thinking you can get a better sign once business improves.

- OFF BALANCE SHEET ACCOUNTING - Encourages a dollar-for-dollar expense for usage without reporting the asset on your books, therefore probably reducing Property Taxes.

- SAVES CASH TO APPLY TOWARDS OPERATING YOUR BUSINESS

Your Payment Alternatives - Solving Cash Flow

Cash flow can be achieved in different ways. There’s credit cards, and there’s third party financing such as bank lending or lease funding. If your objective is cash flow there is no real difference. But if your objective is to look at a much broader picture, then the method you choose to finance can make a huge impact on your business bottom line.

- Your Cash Out of Pocket - When you pay out of pocket for signs and/or other equipment there is no real cash flow solution. You take cash from your business. You rely on depreciation schedules to recoup your investment dollars. You do, of course, pay less in total for your sign this way, because banks and loan providers do try to make money for taking financing risks.

- Somebody Else's Cash - The two most common forms of equipment financing come from bank funding or from lease funding. Both provide exceptional cash flow, but there are very distinct differences in these two forms of funding, including tax treatment, and how the asset is recorded on your books.

Let’s explore these two options

Paperwork

- Bank Loan: Typically a financial package will be required which may consist of tax returns, business plans, usage of asset , ROI projections, proof of debt to income ratios.

- Leasing: A one page application can enable an established business to get up to $200,000.

Timing

- Bank Loan: It is not uncommon to have decisions take 2 or 3 business days or more, depending on the loan type requested

- Leasing: Decisions are usually given within 3 or 4 business hours, or even less in some cases.

Credit Ratings

- Bank Loan: Most bank loans may report the note against you personally, even if a business note, so this can potentially have an adverse effect on your debt to income ratios. Many times blanket lien positions are required, tying up other more valuable assets.

- Leasing: Is “off the books” financing… no reporting to the personal credit agencies… no blanket lien positions needed, offering added protection.

Equity Positions

- Bank Loan: Be prepared to show loan to value ratios. Compensating balances may be required. Down payments are quite common.

- Leasing: None of these are applicable. It’s truly 100% financing. There is no equity position needed.

Dollar Differences

- Bank Loan: Bank rates will be lower, saving you money over the term of the note. But, the difference probably is minor if you factor in all that is needed to secure this savings.

- Leasing: Your cost of funds will be higher, but the difference will potentially be mostly recouped in the different way you record the asset in your books, also reducing your Property Taxes.

Note: Consult your tax advisor when entering into any financing commitment. Every bank policy is different.

The Process is Easy

- Step 1 - APPLYING MADE CONVENIENT | Applications can be accepted via phone, fax, email, text or on the web.

- Step 2 - QUICK TURN-A-ROUND | In about three hours or less, we will have a decision in place and issued.

- Step 3 - APPROVAL AND TERMS OUTLINED | You’ll receive an email and/or a call confirming the approval details.

- Step 4 - VERIFY EQUIPMENT DETAIL | We’ll simply make sure that the equipment details are confirmed, including final pricing.

- Step 5 - VERIFY TERM AND CREATE DOCS | Then we verify the term desired and create a lease pack and email it to you.

- Step 6 - RECEIVE SIGNED DOCS AND BEGIN | Once we receive the signed docs via email or fax, we begin the production process.

Ready to Pre-Apply On-line?

Ready to Pre-Apply by Phone, FAX or Mail?

(Adobe Acrobat required.)

Literature

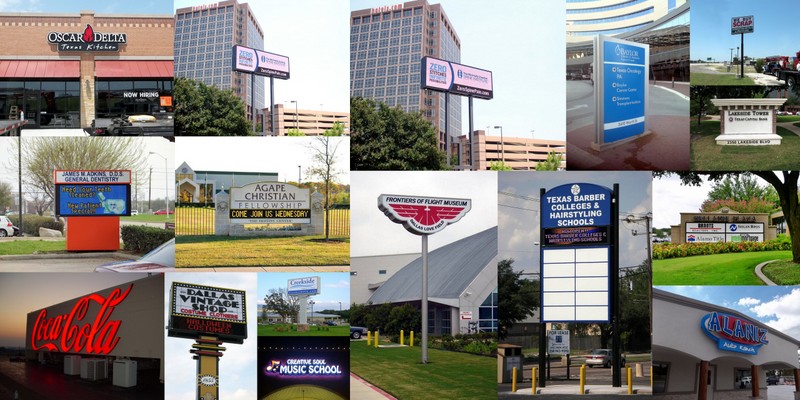

We believe we are the only sign company that offers informative literature on signage, our "Sign Buyer's Guide" series.

Our most popular Guides are:

52 Page Brochure

44 Page Brochure

40 Page Brochure

40 Page Brochure

40 Page Brochure

40 Page Brochure

Also Available

Also Available

|

104 Product Videos |