Saving Money On Your Signage

Don't Pay Full Price For Signage

We have been saving customers money since 1979.

Signs Manufacturing will reduce your tax burded for your new signs considerably, saving you THOUSANDS on large sign purchases. Most sign companies cannot do this. But our unique in-house manufacturing, installation and service abilities allows us to pass savings on to you.

Before throwing your money away to the State, call Signs Manufacturing and let us explain how we can cut your costs for your new signs.

Why Not Purchase Outright?

Most of the time, about 80%, signs are purchased outright. That allows them to immediately be expensed, reducing your tax bill. However, that's not necessarily the best way to do it.

What if you could pay just pennies on the dollar today, but write off the ENTIRE sign purchase in this year's taxes? You can!

That's how a lease works. You save money in two different ways; It gives you the ability to keep your cash now so you can use it for other necessities in your business AND you'll get a tax break thanks to Section 179 for the current year!

Leasing isn't for everybody. But for a business, it means you can get the sign you need today without having to pay for it today.

It's worth considering.

We build signs, we aren't a leasing company. But we will work in whatever way best first your needs. If you would like to consider a lease, we can help you with that as well.

Get the Best of Both Worlds

With a lease-to-own sign finance solution, small businesses can enjoy using their signage daily, knowing they will eventually own it. This solution offers the advantage of affordable monthly payments that fit your budget.

Maximize Your Benefits

Imagine being able to invest in your signage today, keep more money in your pocket, and still claim the entire purchase on this year’s books. SECTION 179 of the IRS Tax Code allows you to avoid complex depreciation schedules and reduce your tax liability.

Qualifying Equipment

- Business Equipment of All Types—To qualify, signage, vehicle(s), and/or software must be used for business purposes more than 50% of the time. Your sign qualified because it's used for business 100% of the time!

- Vehicles Designed For Commercial Use - Vehicles with 6,000+ pounds GVW are limited to a $25,000 deduction.

- Off-the-Shelf Software—Software readily available for purchase by the general public with a non-exclusive license & not substantially modified. Websites do not qualify.

How Much Money Can Section 179 Save Your Business*

As an example, for $10,000 sign if you purchase it outright you pay $10,000 now and get to write off that purchase on your taxes, saving you $2100 if you're in the 21% tax bracket.

If you lease it, you only pay a few hundred dollars now and STILL get to write off the entire purchase on your taxes, saving you $2100! Would that be helpful to your business?

Our easy-to-use calculator will help you estimate your savings. Just enter your equipment price and select your tax bracket, and our calculator will do the rest.

Literature

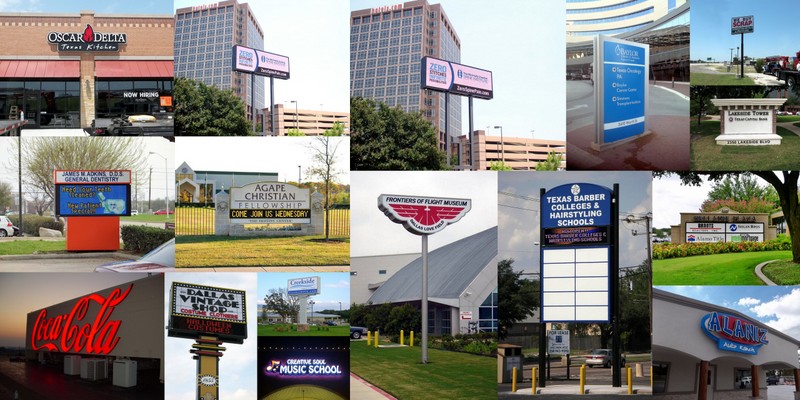

We believe we are the only sign company that offers informative literature on signage, our "Sign Buyer's Guide" series.

Our most popular Guides are:

52 Page Brochure

44 Page Brochure

40 Page Brochure

40 Page Brochure

40 Page Brochure

40 Page Brochure

Also Available

Also Available

|

104 Product Videos |